Review of WILL-being 2023, the Medium-Term Management Plan

- TOP

- Medium-Term Management Plan

- Review of WILL-being 2023, the Medium-Term Management Plan

General Overview

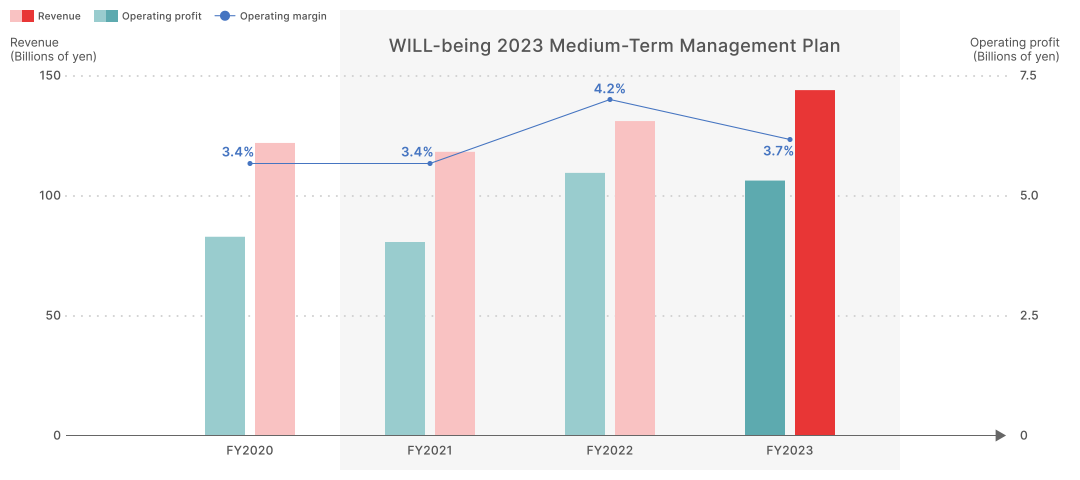

Compared with the beginning of the previous Medium-Term Management Plan in March 2020, we have seen consistent growth in both revenue and operating profit. Although revenue growth was supported by favorable exchange rates, operating profit fell slightly short of our target due to slowness in the Domestic Working business segment.

In the context of our key strategies I to III —to utilize a portfolio shift to improve profitability, utilize a digital shift to improve productivity, and search for the next strategic investment domain —we faced some delays in implementing the plan that required strategic adjustments, leading to some unmet objectives. However, in the case of the key strategy IV, our financial strategy, we achieved significant results with a percentage of equity attributable to owners of parent to total assets of 26.6% and a total dividend payout of 31.2%.

| Key strategies | Details | Assessment | ||

|---|---|---|---|---|

| Strategy Ⅰ | Utilize a portfolio shift to improve profitability |

Indicators

| Unsatisfactory | Strategic investment domain

|

| Unsatisfactory | Profit maximization area

|

|||

| Strategy Ⅱ | Utilize a digital shift to improve productivity |

|

Poor |

|

| Strategy Ⅲ | Utilize a digital shift to improve productivity |

|

Poor |

|

| Strategy Ⅳ | Financial strategy |

|

Good |

|

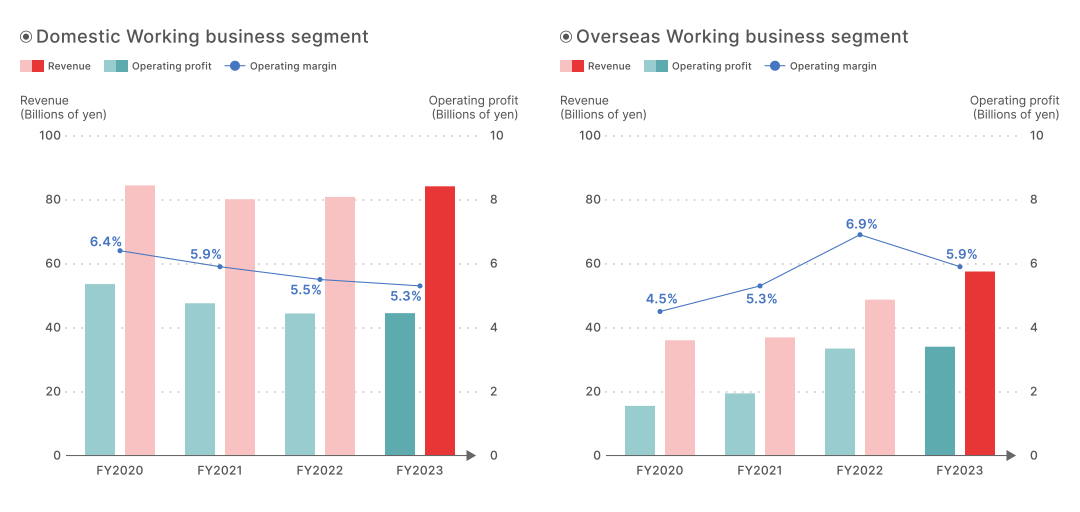

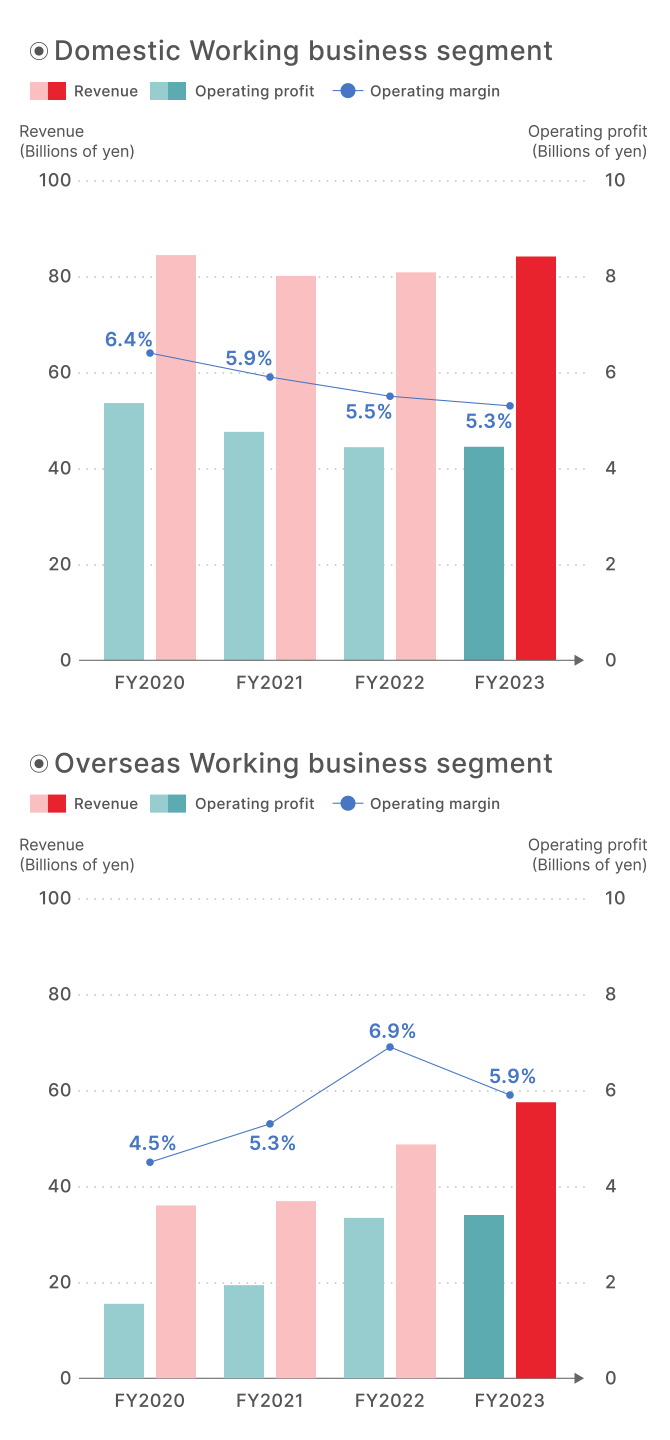

Revenue and Operating Profit by Business Segment

Ongoing Challenges for the New Medium-Term Management Plan

The persistent challenges to be addressed in the new Medium-Term Management Plan include the operating margin, which remains stagnant in the 3% range due to a challenging hiring environment in the core sectors of the Domestic Working business segment (sales, call centers, and factories), a strategic shift in the temp-to-hire placement model in the nursing care sector, and a focus on financial stability that has resulted in a suspension of new M&As.

| Challenges | |

|---|---|

| Common | Stagnant operating margin, hovering around the 3% mark (FY2020: 3.4% to FY2023: 3.7%) |

| Domestic Working Business segment | In the construction management engineer areas, hiring is not progressing as expected and we are one year behind our plan. |

| The hiring environment is slowing in the focus areas of the Domestic Working business segment: sales, call centers, and factories. | |

| Due to the strategic shift in the placement of people hired in the temp-to-hire category in nursing care, our growth drivers have declined. | |

| The hiring environment in Japan is expected to slow even more. | |

| By focusing on financial stability and not conducting M&As, growth has slowed over the past three years. | |

| Overseas Working Business Segment | Acceleration of growth in the Overseas Working business segment. |