WILL-being 2026, the Next Medium-Term Management Plan

- TOP

- Medium-Term Management Plan

- WILL-being 2026, the Next Medium-Term Management Plan

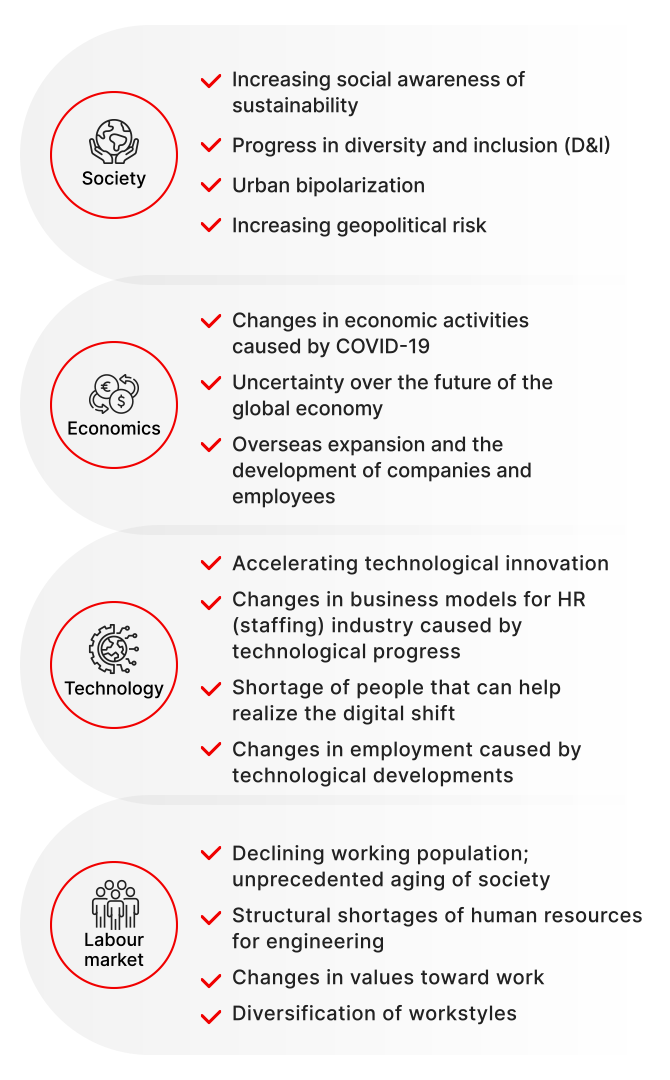

Changes in the External Environment

The external environment surrounding the WILL GROUP is constantly changing, encompassing politics, economics, society, technology, and other areas. We particularly recognize that technological innovation is driving changes in the labor market that will significantly impact business models in the HR (staffing) industry.

The Issues Facing Society

Roles that do not require human intervention are increasing, such as manufacturing done by robots and administrative work done by AI. At the same time, there is an increasing mismatch in the job market, with a shortage of skilled employees capable of leading technological change and who are suited to working in business. This gap is growing between the required skills and the available skills. To address this mismatch in the job market, the WILL GROUP is committed to maximizing and optimizing the career paths that transform workers into experts.

WILL-being 2026, the Next Medium-Term Management Plan

Basic Policies

For the Group to grow sustainably, it is important to stimulate growth in the stagnant Domestic Working business segment. Therefore, this medium-term plan sets out renewed growth of the Domestic Working business segment as the basic policy with aggressive upfront investments for the renewed growth and a change in the Company’s profit structure during the plan’s term, in this way establishing a foundation for dramatic growth in the future.

Management Indicators

| FY2023 | FY2026 (Plan) | FY2023 → FY2026 | ||

|---|---|---|---|---|

| Targets | Revenue (Billions of yen) *New M&As not included |

143.9 | 170.0 | CAGR +6% |

| Operating profit (Billions of yen) (Operating margin) |

5.31 (3.7%) |

6.50 (3.8%) |

CAGR+7% (+0.1pt) |

|

| KPI | Number of permanent employees on assignment for non-fixed term staffing service/year (Construction management engineer domain) |

1,000 | 2,000 | +1,000 |

| Retention rate (Construction management engineer domain) |

71% | 73% | +2pt | |

| Number of permanent employees on assignment for non-fixed term staffing service (Domestic W [excluding the construction management engineer domain]) |

2,450 | 4,700 | +2,250 | |

| Number of foreign talent supported through the Foreign Talent Management Service (Domestic W [excluding the construction management engineer domain]) |

1,750 | 6,800 | +5,050 | |

| Permanent placement revenue composition (Overseas W) |

14% | 17% | +3pt |

Key Strategies

In the new Medium-Term Management Plan, we have identified four key strategies for achieving our management goals: Strategy I, realizing more growth and monetizing the construction management engineer area; Strategy II, renewed growth in the Domestic Working business segment (excluding construction management engineers); Strategy III, stable growth in the Overseas Working business segment.

| Domestic Working Business Segment | Strategy Ⅰ |

Realize more growth and monetization in the construction management engineer area | Double the recruitment of people with no experience, including new graduates 1,000 people (FY2023) → 2,000 people (FY2026) |

|---|---|---|---|

| Strategy Ⅱ |

Renewed growth in the Domestic Working business segment (excluding construction management engineers) |

|

|

| Overseas Working Business Segment | Strategy Ⅲ |

Renewed growth in the Domestic Working business segment (excluding construction management engineers) | Improve the stability of existing business segments |

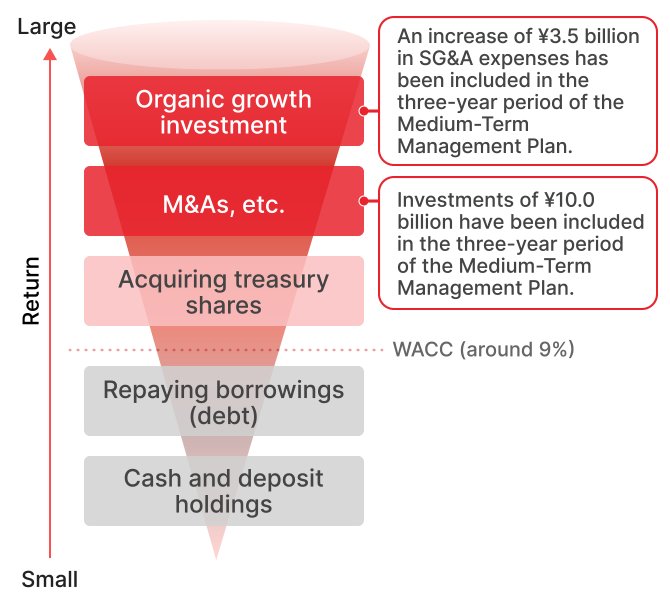

Cash Allocation Policy

We are prioritizing funds for increasing SG&A expenses for investments in organic growth and M&As. If surplus cash is available, we will consider acquiring treasury shares, based on our financial results.

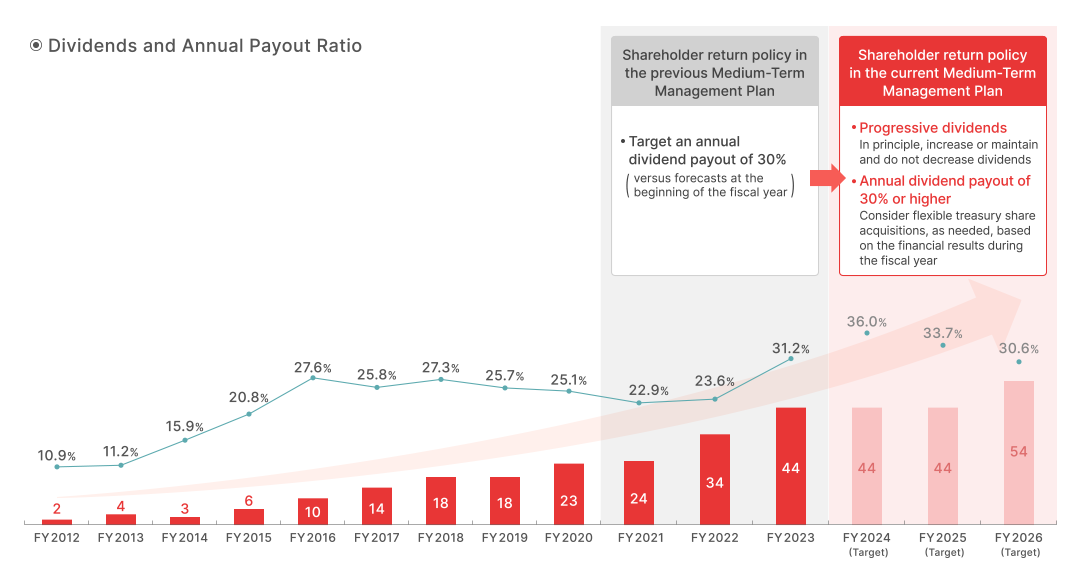

Shareholder Return Policy

In the first and second years of the current Medium-Term Management Plan, we expect profits to decline compared with fiscal 2023. As a result, we have changed our shareholder return policy included within the plan. Now, we are using a progressive dividend approach, aiming to increase or maintain the percentage for dividends without any reductions, in principle. We are also aiming for an annual dividend payout of 30% or higher.