WILL-being 2026, the Next Medium-Term Management Plan

- TOP

- Medium-Term Management Plan

- WILL-being 2026, the Next Medium-Term Management Plan

Progress Status of the “WILL-being 2026” Medium-Term Management Plan

Background to revising the management targets

With a year having passed since we announced the Medium-Term Plan, the hiring of people with no experience—including new graduates—is making steady progress in the construction management engineer domain of the Domestic Working Business, a domain which is the Group’s key focus area. It has now become certain that this domain will become profitable in the fiscal year ending March 31, 2025. In addition, although progress regarding foreign talent management service has been slower than planned, the situation has been gradually recovering since the third quarter of the previous fiscal year, and we are seeing results close to targets on a quarterly basis. On the other hand, there were difficulties in building up the number of workers on permanent employee staffing and existing fixed-term employee staffing in domains other than the construction management engineer domain, with revenue of the Domestic Working Business remaining flat. Uncertainty also persists in the Overseas Working Business, with reduced hiring by major clients becoming prolonged after the post-COVID-19 surge in placement demand has run its course. In addition, the Company aggressively pushed forward with the review of its business portfolio, including the sale of shares, etc. of its listed subsidiaries, which was not included in the Medium-Term Plan. As a result, the profits of these subsidiaries are expected to be lost from the fiscal year ending March 31, 2025, onwards. For this reason, conditions have deviated from those assumed when formulating the Medium-Term Plan. Under these circumstances, we need to avoid a situation where we place too much emphasis on achieving the management targets for the fiscal year ending March 31, 2026, and end up with scraping together profits in an unreasonable manner and cutting back on investments that would otherwise lead to future growth, among others. To ensure that management decisions regarding sustainable growth are not impaired, the Company has decided to withdraw some of the management targets laid out in the Medium-Term Plan, such as those for revenue, operating profit and operating margin. We will also revise the KPIs to a reasonable level so as to pursue the achievement of the KPIs as a priority. Nevertheless, the basic policies and three key strategy targets of this Medium-Term Plan will remain unchanged, and we will continue to work to achieve sustainable growth.

Basic Policies

For the Group to grow sustainably, it is important to stimulate growth in the stagnant Domestic Working business segment. Therefore, this medium-term plan sets out renewed growth of the Domestic Working business segment as the basic policy with aggressive upfront investments for the renewed growth and a change in the Company’s profit structure during the plan’s term, in this way establishing a foundation for dramatic growth in the future.

Refer to the official corporate site for the initial Medium-Term Management Plan.

Management Indicators/KPIs

Shifting to a style of management focused on maximizing strategy implementation, we are prioritizing the following KPI targets with the aim of achieving a “leap” phase of fast progress beginning in the fiscal year ending March 2026.

| FY2023 Results |

FY2024 Results |

FY2026 Targets (pre-revision) |

FY2026 Targets (post-revision) |

||

|---|---|---|---|---|---|

| Target | Revenue (Billions of yen) | 143.9 | 138.2 | 170.0 | - |

| Operating profit (Billions of yen) | 5.31 | 4.52 | 6.50 | - | |

| Operating margin | 3.7% | 3.3% | 3.8% | - | |

| KPIs | Number of permanent employees on assignment for non-fixed term staffing service/year (Construction management engineer domain) | 1,022 | 1,424 | 2,000 | 1,500 |

| Retention rate (Construction management engineer domain) | 71.3% | 71.2% | 73.0% | 71.5% | |

| Number of permanent employees on assignment for non-fixed term staffing service (Domestic W [excluding the construction management engineer domain]) | 2,791 | 3,254 | 4,700 | 3,500 | |

| Number of foreign talent supported through the Foreign Talent Management Service (Domestic W) | 1,750 | 2,341 | 6,800 | 3,500 | |

| Permanent placement revenue composition (Overseas W) | 13.5% | 11.6% | 17.0% | - | |

*1: For the targets after the revision that are indicated with “–,” the actual results will be disclosed every quarter.

*2: Number of workers on assignment for permanent employee staffing (Domestic Working Business [excluding the construction management engineer domain]) includes the sales outsourcing domain, factory outsourcing domain, IT engineer domain, call center outsourcing domain and nursing care domain.

Key Strategy and Initial FY Status

StrategyⅠ

Realize more growth and monetization in the construction management engineer area

Overview

We will achieve profitability in FY2025 by working to improve productivity in the architect engineer sector and making it a pillar of business in FY2026.

Status at Beginning of Fiscal Year

Further growth in the architect engineer sector to achieve profitability

Strong hiring of personnel without experience, including new university graduates, ensuring profitability in FY2025

StrategyⅡ

Renewed growth in the Domestic Working business segment (excluding construction management engineers)

Overview

We will work to expand foreign talent management service and assignment for permanent employee staffing. For the expansion of foreign talent management service, we will strengthen the acquisition of new orders by increasing the number of sales personnel, and for local hiring, we will strengthen alliances with local corporations, schools, etc. For expansion of assignment for permanent employee staffing, we will extend the recruiting know-how cultivated in the construction management engineer domain and sales outsourcing domain to the factory outsourcing domain. In addition, in anticipation of a tougher hiring environment in the future, we will implement brand promotions to strengthen our own brand.

Status at Beginning of Fiscal Year

Struggle to accumulate numbers of permanent employees on assignment for non-fixed term staffing service

Foreign talent management service is behind schedule but gradually recovering

StrategyⅢ

Stable growth in Overseas Working Business

Overview

The future of the permanent placement market is uncertain in both Singapore and Australia, with reduced hiring by major clients becoming prolonged after the post-COVID-19 surge in placement demand has run its course. In this situation, the Company will work to expand permanent placement sales once demand recovers while securing talented consultants. In order to reduce downside risk and improve business stability, the Company will also work to increase temporary staffing sales in stable areas such as government while also exercising cost control and strengthening governance.

Status at Beginning of Fiscal Year

Long-term sluggishness in markets for both temporary staffing and personnel placement agency services

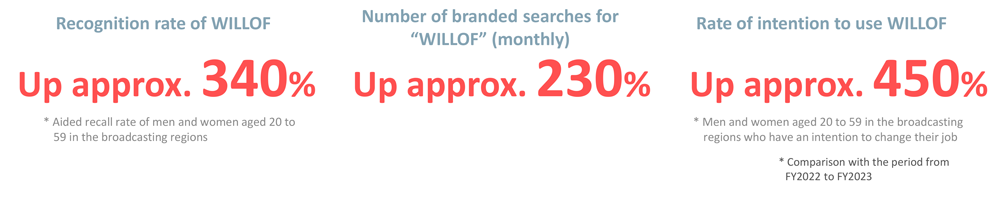

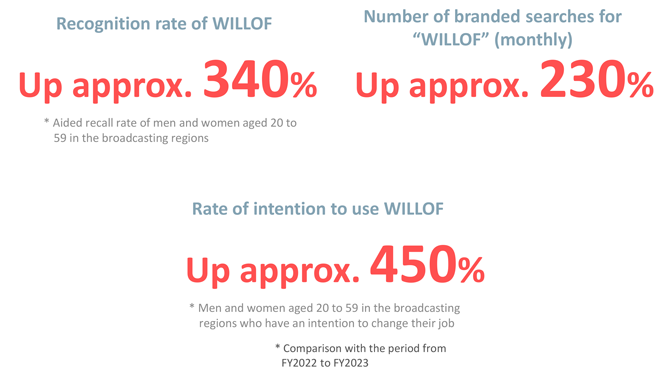

Topic: Impact of the “WILLOF” Promotion

We have been running broadcast TV commercials featuring celebrities in the Kanto, Nagoya, Kansai, Fukuoka, and Okinawa areas to promote the WILLOF brand for the Domestic Working business. We also ran YouTube and other Internet ads.

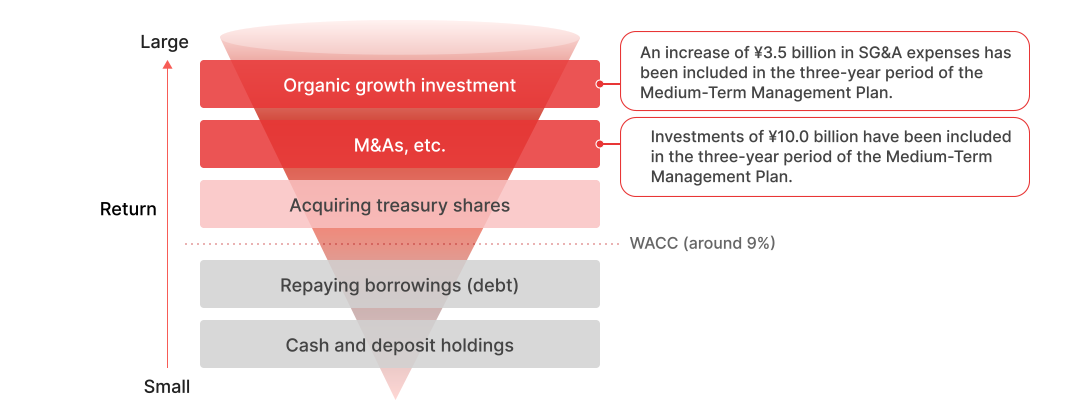

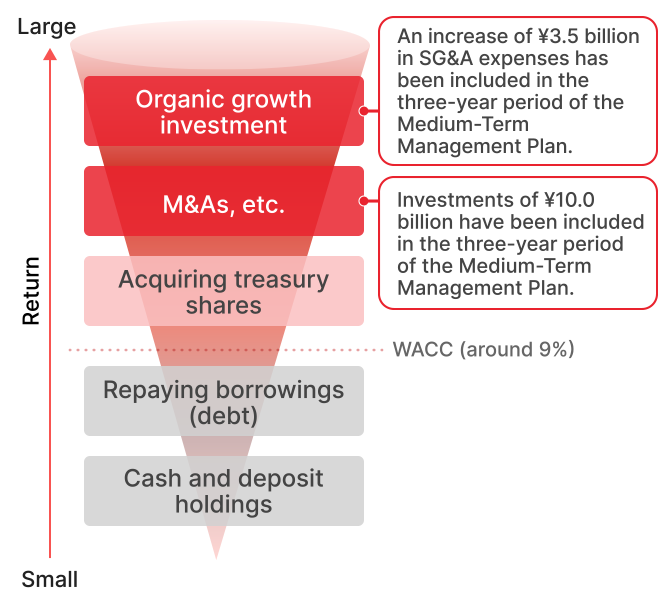

Cash Allocation Policy

We are prioritizing funds for increasing SG&A expenses for investments in organic growth and M&As. If surplus cash is available, we will consider acquiring treasury shares, based on our financial results.

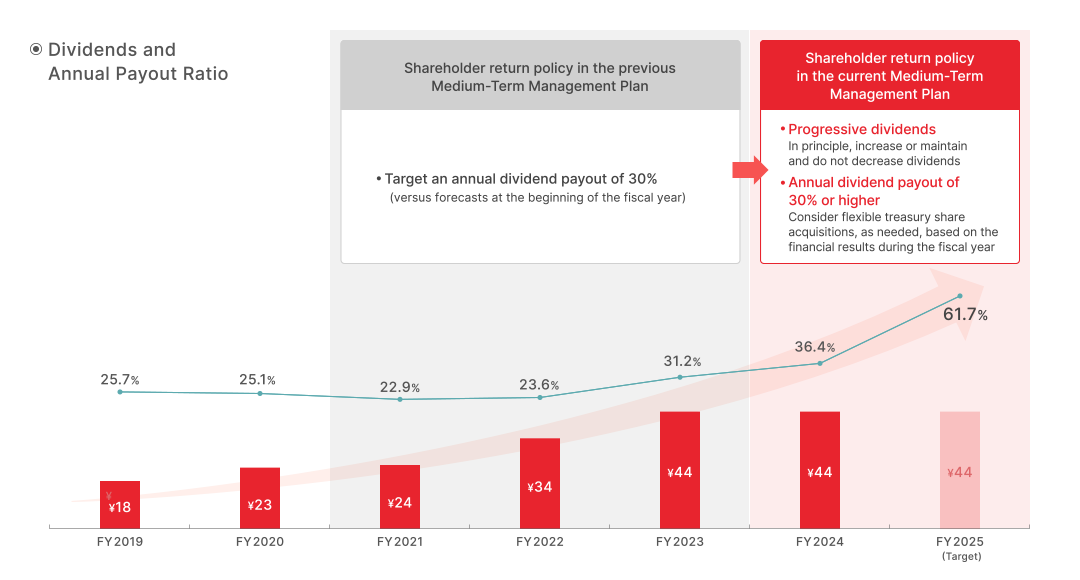

Shareholder Return Policy

In the first and second years of the current Medium-Term Management Plan, we expect profits to decline compared with fiscal 2023. As a result, we have changed our shareholder return policy included within the plan. Now, we are using a progressive dividend approach, aiming to increase or maintain the percentage for dividends without any reductions, in principle. We are also aiming for an annual dividend payout of 30% or higher.