Fiscal year ended March 31, 2025 Overview

Revenue growth was driven by the continued expansion of strategic investment domains, led by the construction management engineer domain of Domestic Working Business. Focusing on strategic investment areas led to progress in the restructuring of the business portfolio and to a steady improvement in the normalized operating margin.

During the fiscal year under review, while the global economy continued to grow at a moderate pace against the backdrop of easing inflation rates in various countries, the outlook remains uncertain due to such factors as growing tension in the situation in Russia and Ukraine as well as in the Middle East, and the impacts from U.S. trade policies. Accordingly, it is necessary to continue closely monitoring the impacts of these factors.

While the Japanese economy showed positive trends, such as continued wage increases and propensity toward capital investment by corporations, the recovery was muted due to weakening consumer spending from the impact of rising prices. In addition, the risk of downward pressure on Japan’s economy has intensified with the increased uncertainty for the future of the global economy due to concerns surrounding the tariff policies put forward by the U.S. government.

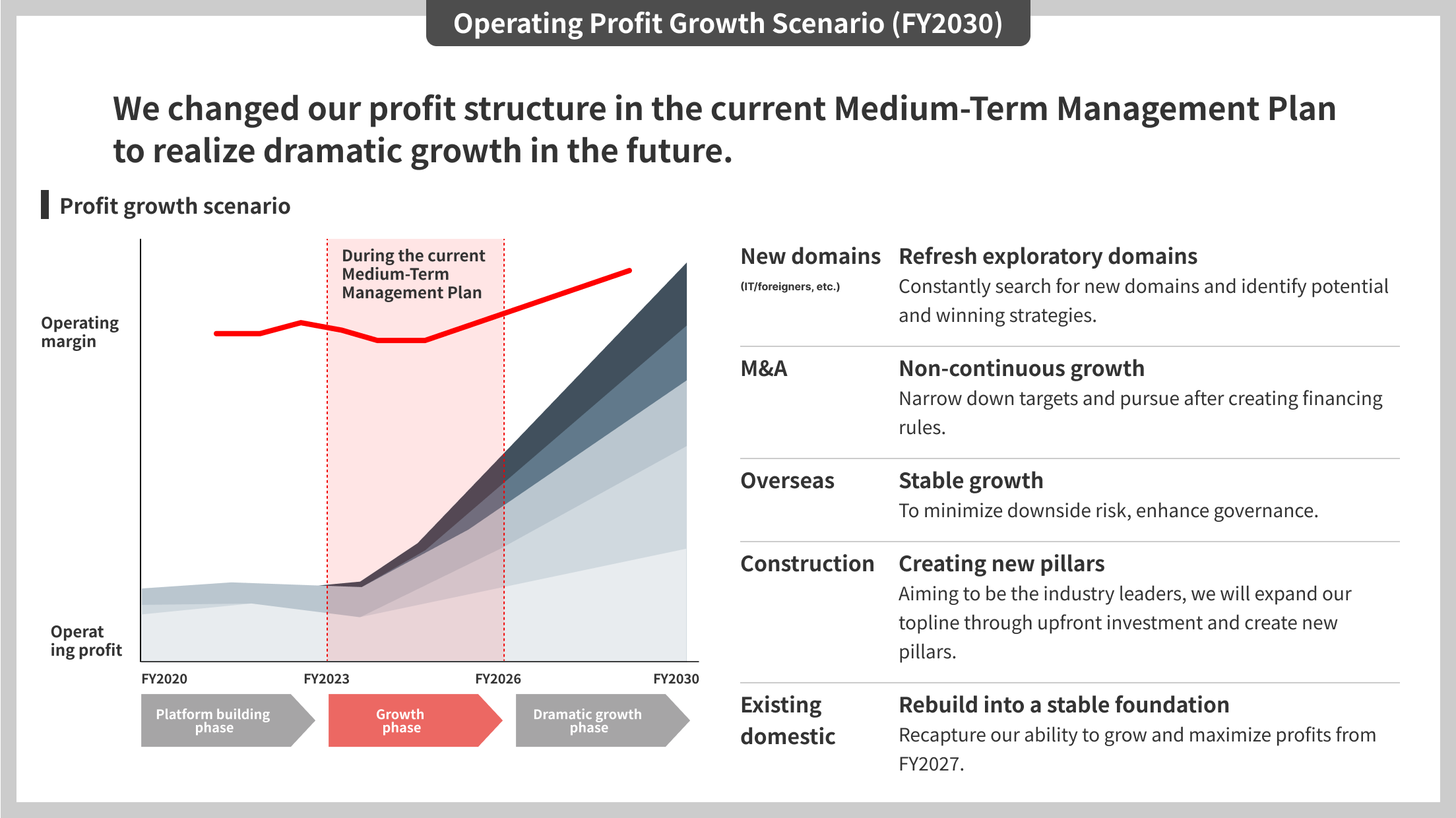

Under these circumstances, the Group worked to expand the construction management engineer domain, permanent employee staffing, foreign talent management service, and other initiatives for the renewed growth of the Domestic Working Business, which is the basic policy in the Medium-Term Management Plan “WILL-being 2026,” (hereinafter the Medium-Term Plan) for which the final fiscal year is the fiscal year ending March 31, 2026.

In Japan, business remained steady except for the call center outsourcing domain. In particular, the construction management engineer domain, which is a strategic investment domain, expanded steadily and achieved profitability. In addition, in order to strengthen hiring capabilities in Japan, the Company ran TV commercials as promotion of “WILLOF” brand in 18 prefectures that include the Kanto area, which is the Company’s largest market area, and also developed a promotion strategy utilizing the web commercials and social media, etc.

In the overseas segment, the Company has been implementing cost control measures aimed to continuously strengthen its earnings structure due to prolonged reduction in hiring by major clients since the post-COVID-19 surge in permanent placement demand has run its course, with the impact of inflationary pressures compounding the situation, and continues to take measures to secure sustainable revenue even under market conditions where demand for manpower is weak.

As a result of the above, revenue during the fiscal year under review was ¥139,705 million (up 1.1% year on year), operating profit was ¥2,338 million (down 48.3%), profit before tax was ¥2,177 million (down 50.7%), profit was ¥1,141 million (down 60.3%), profit attributable to owners of parent was ¥1,155 million (down 58.4%), and EBITDA (operating profit + depreciation and amortization + impairment losses) was ¥4,896 million (down 28.1%).

For the fiscal year ended March 31, the Company will pay a year-end dividend per share of ¥44 (ordinary dividend of ¥44) in accordance with the dividend forecast announced on May 13, 2024. As a result, the total payout ratio will be 87.9%.