Corporate governance

Basic views

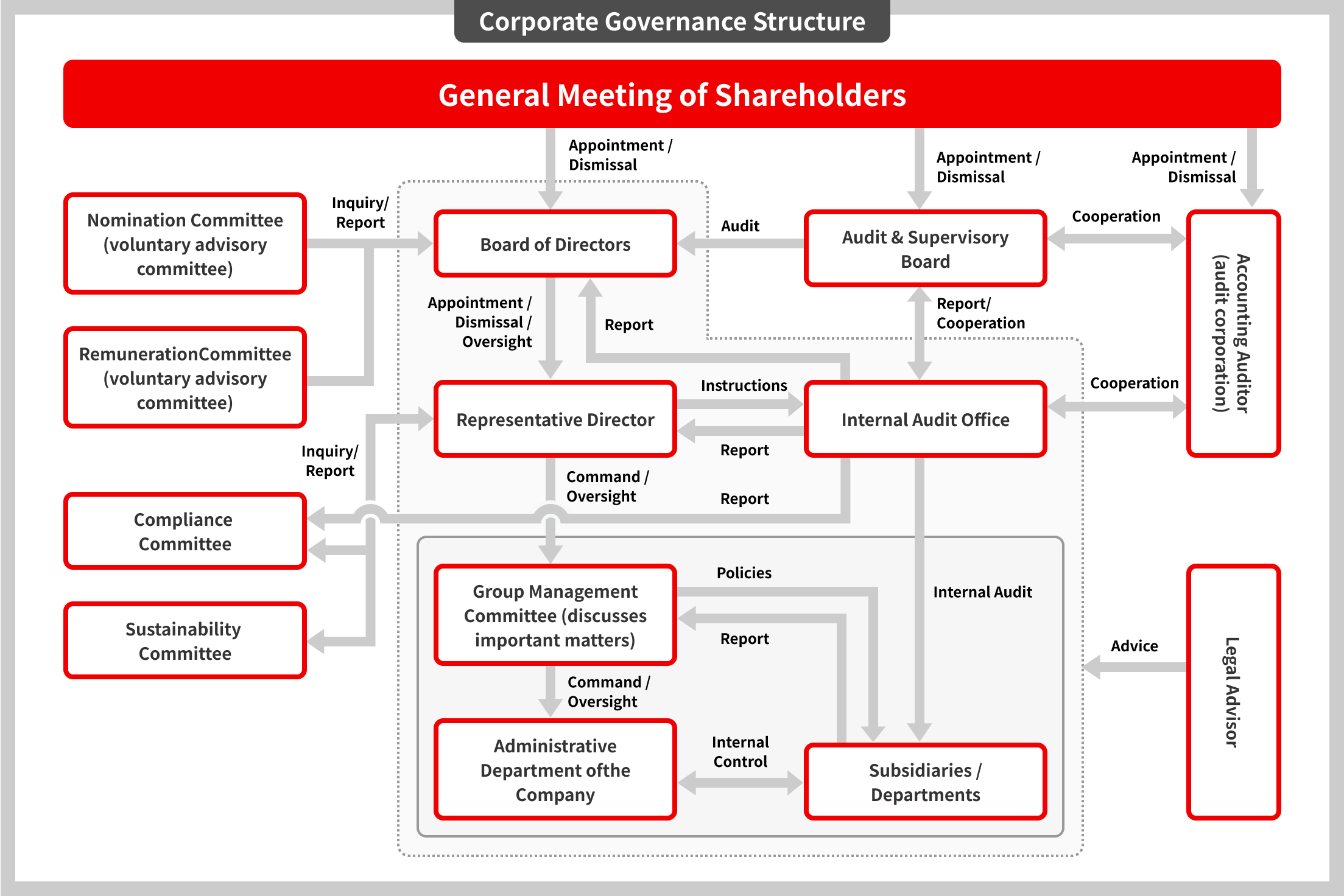

In order to ensure management transparency and compliance, the Company shall establish a system that can respond quickly and flexibly to changes in the business environment of the entire Group while enhancing corporate governance. In addition, the Company develops company-wide activities through various measures in order to permeate corporate ethics and corporate philosophy throughout the entire Group.

Outline of “Independence Criteria for Outside Directors” (PDF)

Corporate governance system

-

(1) Board of Directors

The Company’s Board of Directors consists of five directors, namely Chairman and Director Ryosuke Ikeda, President and Representative Director Yuichi Sumi, Chie Ikegawa, Kunihiro Koshizuka and Masato Takahashi(Chie Ikegawa, Kunihiro Koshizuka and Masato Takahashi are outside directors), and in addition to the regular monthly meetings, extraordinary meetings of the Board of Directors are held as necessary.

The Board of Directors, as a management decision-making body, resolves important matters in accordance with the Board of Directors regulations and supervises the status of business execution by the directors.

The Board of Directors is attended by three auditors (including three outside Audit & Supervisory Board members) to ensure that important decisions are always audited. -

(2) Audit & Supervisory Board

The Company is a company with an Audit & Supervisory Board. The Company’s Audit & Supervisory Board consists of three outside Audit & Supervisory Board members, namely, Shizuka Sawada, Kenji Omukai and Katsumi Nakamura.

Each Audit & Supervisory Board member audits the execution of duties by directors by attending meetings of the Board of Directors and other important meetings in accordance with the audit plan formulated by the Audit & Supervisory Board. The Audit & Supervisory Board, which meets regularly once a month and asnecessary, determines audit policies and plans, and exchanges opinions on compliance issues. In addition, they receive quarterly explanations and reports on financial results from the accounting auditor, and exchanges information and opinions with the accounting auditor as necessary.

Audit & Supervisory Board members Shizuka Sawada and Kenji Omukai are certified public accountants,and Katsumi Nakamura is a lawyer. -

(3) Advisory Committees on Nomination and Remuneration

To increase the transparency and objectivity of the examination process for the appointment of director candidates and the remuneration of directors, discussions and confirmations are performed in advance regarding matters on nomination and remuneration by the Nomination Committee and Remuneration Committee. The results of these discussions are then submitted to the Board of Directors, which makes final decisions.

・Nomination Committee

The Company’s Nomination Committee consists of two inside directors, three outside directors and three outside Audit & Supervisory Board members. Its chairperson is chosen from among outside directors.

It deliberates on matters related to the training and development of successors as part of the succession planning for the CEO, and matters related to the appointment and dismissal of directors.

The members of the Nomination Committee are as follows.・Inside directors

Ryosuke Ikeda (Chairman and Director), Yuichi Sumi (President and Representative Director)

・Outside directors

Chie Ikegawa (Chairperson), Kunihiro Koshizuka and Masato Takahashi

・Outside Audit & Supervisory Board members

Shizuka Sawada, Kenji Omukai and Katsumi Nakamura

・Remuneration Committee

The Remuneration Committee consists of three outside directors. Delegated by the Board of Directors, the Remuneration Committee deliberates and confirms the amounts and evaluations of individual remuneration of directors within the scope of the remuneration system and maximum amount of remuneration decided by the general meeting of shareholders and the Board of Directors.The member of the Remuneration Committee are as follows.

・Outside directors

Chie Ikegawa (Chairperson), Kunihiro Koshizuka and Masato Takahashi

-

(4) Compliance Committee

The Compliance Committee, chaired by the representative director and consisting of the Group’s directors and employees selected from within the Company, ensures that the Company is in compliance with the laws and regulations. Each director or executive officer works to raise awareness of compliance by ensuring that all departments under their control are thoroughly aware of compliance.

Please make inquires about compliance here. -

(5) Sustainability Committee

In April 2022, the Company established the Sustainability Committee chaired by President and Representative Director as the deliberating body for sustainability. The Sustainability Committee is composed of the Company’s inside directors and the directors of its main domestic subsidiaries as committee members.

The Sustainability Committee discusses, evaluates, and formulates activity policies and action plans relating to sustainability and monitors the promotion of KPI for materiality issues.The contents discussed by the committee will be reported to the Board of Directors. -

(6) Internal Audit Office

The Internal Audit Office of the Company consists of three members. In accordance with the internal audit regulations, the Internal Audit Office provides guidance on compliance with laws, regulations and internal rules, and audits the entire Group on a regular and ad-hoc basis. Not only from the perspective of legality, the office also points out and provides guidance on improving the suitability and efficiency of business operations.

-

(7) Group Management Committee

The Group Management Committee, led by the directors and executive officers of the Group, discusses important matters such as analysis of the recent business environment and performance trends, and medium to long-term business strategies.

Corporate Governance Structure

Basic Views on Internal Control System and the Progress of System Development (PDF)

Ensuring the effectiveness of the Board of Directors and Audit & Supervisory Board

In terms of nominating candidates for Director, the Group aims to strike a balance with accurate and speedy decision-making, appropriate risk management, and business execution monitoring. Furthermore, we take a comprehensive approach that considers gender, internationality, background, and age that can cover company functions and Group company business departments in order to select the best personnel for the best positions.

In terms of nominating Audit & Supervisory Board Member candidates, we take a comprehensive approach to select the best personnel for the best positions while securing a balance of insights into finance and accounting, knowledge related to business fields, and diverse perspectives related to company management.

Furthermore, the Group elects one Outside Director and Outside Audit & Supervisory Board Member who has appropriate knowledge of finance and accounting.

Status of Outside Officers

The Company elects two Outside Directors and three Outside Audit & Supervisory Board Members.

When selecting candidates for Outside Officers at the Company, the Group selects those candidates that satisfy the requirements of independence provided by the Tokyo Stock Exchange and also meet the criteria specified in the “Independence Criteria for Outside Directors” of the Company in order for Outside Directors and Outside Audit & Supervisory Board Members to fulfill the monitoring functions needed.

Outline of “Independence Criteria for Outside Directors” (PDF)

Skill Matrix for Directors and Audit & Supervisory Board Members

The Board of Directors has four inside directors who have a thorough knowledge of the Group’s business operations and three independent outside directors and three outside Audit & Supervisory Board members. These Outside Officers have considerable experience and knowledge that encompasses corporate management, finance and accounting, global business operations, IT/DX, and other areas of expertise. This composition of the board allows the directors to perform their functions effectively and efficiently as well as to effectively oversee business execution.

The Board of Directors determines candidates for directors based on the discussions held by the Nomination Committee. During this process, necessary skills to accomplish the goals of the medium-term management plan are identified. The selection process takes place with the goal of achieving diversity of the board in order to have a proper balance of knowledge, experience and skills.

| Position/ Name |

Attribute | Operational experience/knowledge, etc. | Advisory committee | Expertise | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Independence | Gender Male● Female○ |

Corporate management | Experience in the Company’s business and industry |

Global experience | Finance/ Accounting |

HR, labor, human resources development |

Legal/ Risk management |

IT/Technology | Nomination Committee | Remuneration Committee | Qualifications | |

| Chairman and Director Ryosuke Ikeda |

● | ● | ● | ● | ● | ● | ||||||

| President and Representative Director Yuichi Sumi |

● | ● | ● | ● | ● | |||||||

| Director Takashi Tsugeno |

● | ● | ● | ● | ||||||||

| Director Yuichi Sumi |

● | ● | ● | ● | ● | |||||||

| Outside Director Chie Ikegawa |

● | ◯ | ● | ● | ● | ● | ◎ | ◎ | MBA, PhD (Professional Accounting), small and medium-sized enterprise consultant | |||

| Outside Director Kunihiro Koshizuka |

● | ● | ● | ● | ● | ● | ● | |||||

| Outside Director Masato Takahashi |

● | ● | ● | ● | ● | ● | ||||||

| Full-time Outside Audit &Supervisory Board Member Shizuka Sawada |

● | ○ | ● | ● | ● | ● | Certified public accountant, licensed tax accountant | |||||

| Outside Audit & Supervisory Board Member Kenji Omukai |

● | ● | ● | ● | ● | ● | ● | Certified public accountant, certified public accountant of the State of New York, licensed tax accountant | ||||

| Outside Audit & Supervisory Board Member Member Katsumi Nakamura |

● | ● | ● | ● | ● | Attorney, certified fraud examiner | ||||||

◎ in the Advisory Committee indicates the chairperson.

Effectiveness Evaluation of the Board of Directors (FY3/23)

To improve the functions of the Board of Directors and enhance corporate value, the Company evaluates and analyzes the effectiveness of the Board of Directors.

The evaluations and analysis are conducted using the following method while receiving advice from an external organization.

1. Evaluation method

・From December 2021 through January 2022, surveys were conducted of all five directors (including two outside directors) that make up the Board of Directors and the three Audit & Supervisory Board members (three outside Audit & Supervisory Board members).

・Anonymity was ensured in the response method by having responses sent directly to the external organization.

・Based on the report of the tabulation results from the external organization, analysis, discussion, and evaluation were performed at a regular meeting of the Board of Directors.

2. Results of evaluation

The results of the tabulation of the survey responses produced a mostly positive evaluation on the composition, operating conditions, and contents of discussions of the Board of Directors. The third-party (external organization) analysis also confirmed that the effectiveness of the overall Board of Directors is being ensured.

Major improvements based on the previous evaluation are as follows:

・Strengthened the skill set of the Board of Directors based on the Company’s management strategies by appointing directors who have knowledge of IT and DX.

・Although there is still room for further improvement, ensured the early provision of materials for deliberation by the Board of Directors and secured sufficient time for prior consideration.

3. Future challenges

However, the results also produced opinions mainly on the following issues. There was also a shared awareness that it is necessary to enhance officer training to acquire the required skillset in the light of the management strategy that the Board of Directors is pursuing and to consider the establishment of a monitoring system. Going forward, based on this evaluation of the effectiveness of the Company’s Board of Directors, we will respond to the issues after sufficient review and continue our initiatives to improve the functions of the Board of Directors.

・Consideration of skills that board members should possess as required based on the Company’s management strategy

・Deepening discussions on sustainability based on the medium- to long-term vision of the Company

・Strengthening the supervisory function of the Board of Directors

・Regular sharing with the Board of Directors of issues that have been considered by shareholders and investors and identified through the IR and SR activities